When I settled into my place in Houston, I started buying stocks of canned food and bottled water.

Slowly.

I mean... I buy a but more every time I go to the supermarket. I didn't go down to Walmart or any other supermarket and just buy a whole boot load of stock all at once.

Anyway. I bought 2 cartons of bottled water. Just for emergency.

Otherwise, I usually just drink water from the tap.

Well... it happened.

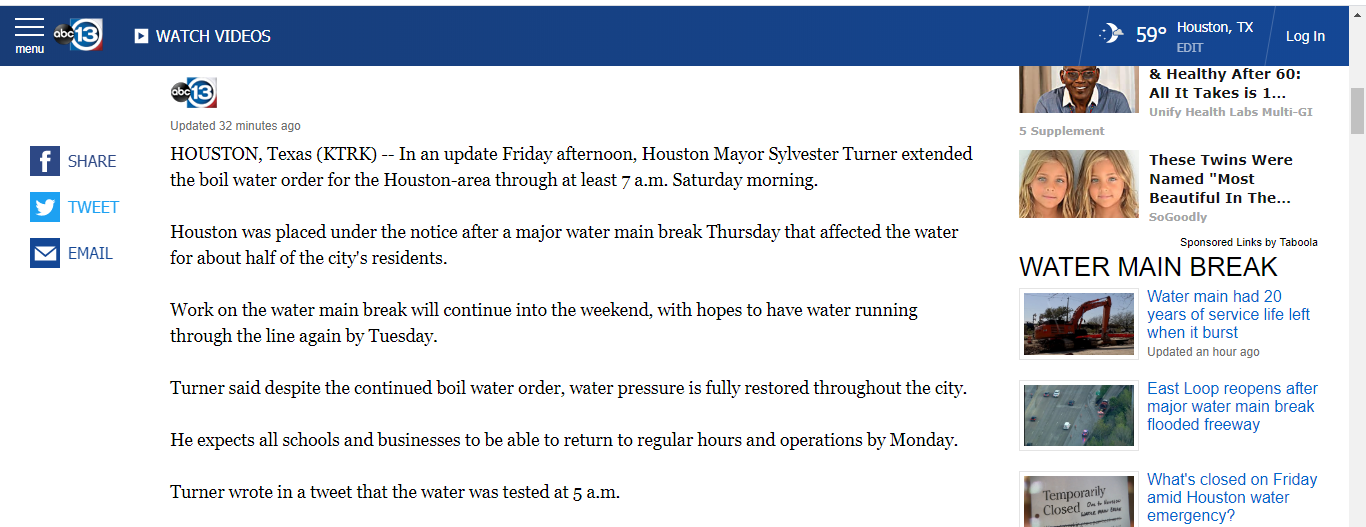

On Thursday, a large water pipe in Houston burst and this water pipe supplied water to around 40-50% of Houston. So when it burst, contaminants got into the water supply and the mayor of Houston declared a boil water notice. Meaning, that the water is not safe for drinking. Even for restaurants, schools, etc. They have to boil their water before they serve it. Same if you want to use water to wash vegetables.

I can't use water to wash dishes cos it's going to contaminate the dishes, etc.

So, when the announcement was made, many people went to the supermarket to buy bottled water. Water supply is expected to resume normal operations by Saturday so it's not really very critical. But many people started stocking up on water.

Also, there were many people who were at work or at school and they were unable to stock up on bottled water.

On Friday, I went to the supermarket to eat breakfast at the McDonald's and I saw many people at the supermarket buying cartons of bottled water.

The thing is... I didn't need to buy. Cos I already had enough bottled water to last me 5 days at least.

I had expected my stocks would come in useful especially during the hurricane season, but this time, my stocks came in useful early. Much earlier than I expected. It doesn't take much space. Just 2 cartons.

But, due to this, I think I'll stock up a bit more food and water. Just in case.

Things aren't as organized and smooth sailing as in SG. I think in SG, 2-3 cartons of water should be enough. But here, I think I'll feel more secure with maybe 4-5 cartons. Things happen. There are issues,, natural disasters, etc... the land is big, if a supermarket goes out of stock, it may be hard for the supermarket to restock again in short notice if there are multiple flooded areas or other issues.

Being new in the country/city, I'm a bit more careful. Cos I don't know how efficient their services are. I don't know how fast they will take to fix issues. I'm not familiar as I am in SG. I don't have support from friends and family. So as issues crop up and as I learn from them, I need to learn to be more prepared for when the next issues strike. Maybe there will be a flood during hurricane and it may take 2 weeks for the flood waters to subside. Then I may not have easy access to food and water. Who knows?

So... for me, I've learnt. To be prepared.

When no one else is being prepared, I try to get myself as prepared as I can be based on my own experiences and my own sense of security.

Then when other people are ganjiong, then I can chill and I don't need to rush to scramble with others to stock up on stuff.

Don't rush when other people rush cos by then, maybe prices are already higher, maybe it's dangerous to go out during that period, maybe there is not enough stocks, could be many things.

That's not to say I'm a doomsday prepper.

I think maybe that's overdoing things. For me, I feel, it's good enough for maybe 2 weeks or 1 month worth of rations just in case anything happens. Cos... natural disasters happen and things may be tough for a while so... better to be prepared than not prepared.

Quite an interesting couple of days. Made me really understand how important it is to be prepared. Cos we don't really have such issues in SG. And made me even more confident that stocking up is important.

Maybe if I'm in SG and during this coronavirus period, and since I have face masks, I'll probably have the same feelings. Cos I already have my stuff ready.

<<PREVIOUS POST // NEXT POST>>

Did you like this post? If so, could you "blanjah" me 1/4 cup of my morning coffee pls.

You may also consider subscribing to receive the articles in your email, link in the column on the right.

RSS Feed

RSS Feed