Generally, I like ETFs. They are simple ways for retail investors to buy a diversified slice of the economy.

Also, it's generally noted that Index trackers perform better over active managers due to increased fees for active managers. Even Warren Buffet recommends buying ETFs as an investment.

I've been thinking though...

The STI Index isn't a basket of wonderful stocks.

It's a basket of stocks picked by some "experts" to give a general feel of the Singapore economy.

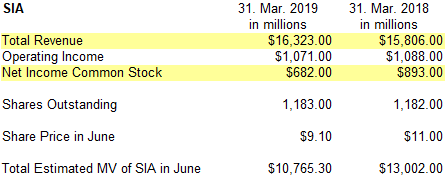

So stocks like CapitaLand, Singapore Airlines, SPH, etc are listed in the index cos overall, the performance of the Singapore economy is also linked with these stocks.

So....

To beat the index probably isn't so hard, just remove 1 stock which probably will under perform the general market.

So for example, if you think that SPH/SIA is probably going to underperform the general index, then just remove SPH, and/or Singapore Airlines, and follow the same weightage as the index for the remaining 28 constituent stocks, then most probably you'll have a better return than the STI index as a whole.

Except of course, it's probably not so easy to rebalance the stocks regularly like how the index does, cos the index is value weighted so as different stocks change in price, the proportion of the stock in the index will change.

But, theoretically, by doing this, you can probably beat the STI index... just that it probably won't be beating the STI index by much, SIA or SPH is only around 3% of the STI index.

Hypothetically, if 97% of the index rises by 10%, and the 3% weaker stocks remains constant, overall the index would have risen by 9.7%.

Whereas if you craft your own portfolio similar to the index but excluding the weak stocks, then you'll get the full 10% return. Cos you exclude the generally weaker stocks. So you could potentially beat the STI Index by 0.3% cos you exclude the "losers".

Hey I said it's easy to beat the index, I didn't say beat it by how much.

You can alternatively, remove 1 or 2 weak stocks from the index, and include 1 or 2 good stocks which are good, but aren't in the index.

But of course the more decisions you have to make, the more chances of making mistakes and not beating the index.

Similarly, you can remove 10 underperforming stocks and add 10 higher performance stocks to the portfolio. But the more you deviate from the STI index, the higher chance that there will be mistakes and you end up underperforming the Index.

So I think it's pretty easy to beat the STI Index... Just make a small tweek. But once you try to change too much, then there is higher risk of errors resulting in underperformance.

What happens is generally, you'll end up getting close to "market returns", but with a small percentage "alpha" over just buying the index.

So I mentioned above that it's going to be troublesome to rebalance the new portfolio cos you need to buy 29 of the same STI Index stocks... Cos as a retail investor it's not really feasible to do that regularly. Another way to probably create a portfolio beating the STI Index, is to use 99% of your portfolio money to buy the STI ETF. Then with the remaining 1% of your portfolio funds, buy a "better" stock.

For example, maybe you feel XYZ company tends to perform better than the overall index. So you buy 99% STI ETF, and 1% XYZ stock.

So once again, you get generally market returns cos 99% of your funds are allocated to the ETF, but 1% you allocate to a potentially better stock. Could even be one of the same stocks as within the STI Index. Meaning you buy a heavier weightage of a potentially better stock.

There are some quite obvious stocks within the STI which regularly outperform other stocks within the STI. (I'm not gonna say which...)

So there you have it. An easy way to probably beat the STI Index. Simply put, just buy similar to the STI Index but change a small bit.

Same same but different.

Once again...

These thoughts are my own analysis and thoughts, please do not use it as an indication to buy or sell. Please do your own research before making any decisions.

<<PREVIOUS POST // NEXT POST>>

Did you like this post? If so, could you "blanjah" me 1/4 cup of my morning coffee pls.

You may also consider subscribing to receive the articles in your email, link in the column on the right.

RSS Feed

RSS Feed