Just because I understand it, doesn't mean I like it.

In truth, I don't like it at all.

Reason being, it is a depreciating investment.

The CPF Min Sum Scheme takes a pool of money and helps Singaporeans invest it.

It pays out a certain amount each month.

This amount is a portion capital and a portion of the returns which the funds have generated.

After a number of years, the money runs out as the capital has been fully paid out and there is no more liability on CPF to continue paying.

For a typical Singaporean, this scheme is actually good. As the fact is many people are not able to handle money.

Readers might be able to handle their funds. But if we're talking about the general population, many Singaporeans are unable to handle a lot of money for a long period of time. This is reported by a Manulife article. I've summarized some key points below. The link to the article is also included.

Longer lives, longer retirement

Many investors underestimate their longevity. Life expectancy data shows that the survey respondents are likely to live up to five years longer than they anticipate. The downside is that their retirement savings will likely run dry before that happens.

Retirement expenditure to exceed expectations

Survey respondents said they expect retirement expenses to average 64 per cent of their current income, but in reality they will likely be much higher. This has not yet hit home with Asia investors for whom retirement is seen as a time when they are free to do what they want (48 per cent), enjoy what they have earned in earlier years (41 per cent), and spend more time with family and friends (40 per cent). Attitudes towards retirement are predominantly positive, with the dark cloud of old age and poor health only a top-three consideration for investors in Indonesia (40 per cent) and Hong Kong (34 per cent).

-Summarized from Manulife website

Well, it is depreciating, meaning that eventually, it will run out. I believe that investments should last forever and capital should never be consumed. Thus, one can put the funds into dividend paying stocks, buy real estate to rent out, etc, the point is to create a passive income stream. The minimum sum scheme goes against this principle.

The minimum sum scheme is also compulsory. Meaning that this forces me, to make a bad investment decision. It makes it compulsory for EarlyretirementSG to put money into this depreciating investment and eat up my own capital. Not to mention that the returns of such annuities are typically about 3%. When my own investments average around 5%.

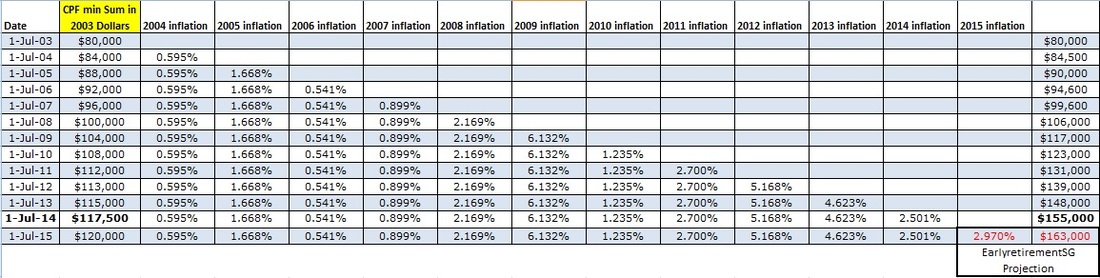

Next thing I do not like about this scheme is that it increases by inflation year on year. For example, if I have SGD155k and I decide to put that money into the minimum sum NOW, by next year, suddenly, I would not have enough in minimum sum again. Imagine a person who had SGD148k (2013 Minimum sum amount) on 30 June 2014, who turns 55 on 1 July 2014. Suddenly, within 1 day, he does not have enough minimum sum? Because minimum sum is not SGD155k from 1 July 2014? That does not make sense. If minimum sum increases by inflation, then the funds in CPF should be growing by at least inflation. But that is a CPF scheme problem.

Nonetheless, EarlyretirementSG does not like the CPF minimum sum for his own investments.

However, he recognizes that this scheme would probably be good for many others who are not good at handling money. See article below.

Straits Times

Two years ago, after her husband was killed in a freak accident while working at Changi Airport's Budget Terminal, she received nearly $1 million in insurance payouts and donations from the public.

Today, that money is all gone.

Madam Pusparani Mohan, 34, is now looking for work in Singapore to support her four young children back in Johor Baru.

Since they can prove that they are money savvy and can handle their money, they should be allowed to continue to make better investments and not be forced to put their money into under performing investments.

It is unfortunate that the policy classifies everyone as the same. Those who can handle money and those who cannot handle money are all treated the same and all have to take up this scheme. This should not be the way that the government or policies work. The policies should be written in a way that allows freedom to those who can prove their abilities and helps and protects people who do not have the ability, discipline or are unable to do it for themselves.

That being said. EarlyretirementSG is NOT against the Minimum sum scheme. I feel that the scheme is useful as statistically, many people are unable to handle their own money. If you can, good for you. But I'm just saying statistically, most people cannot and thus, the scheme should be put in place for these people so that they would have a security net in their retirement. I just feel that there should be more flexibility for this scheme that it should not be imposed on EVERYONE regardless of their financial knowledge and savvy.

<<PREVIOUS POST // NEXT POST>>

RSS Feed

RSS Feed