Cos these are the best times for me to buy my top up card for my M1 prepaid card.

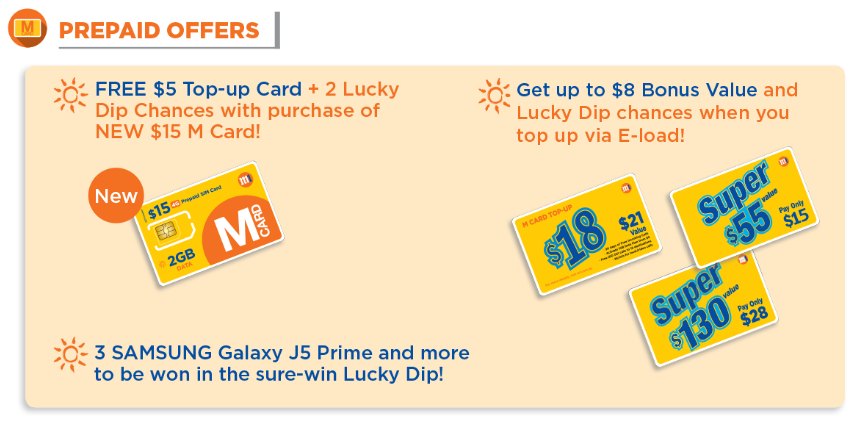

Today, I saw this for this weekend's Comex fair. 31 Aug - 3 Sep @ Suntec

I'm looking at the $29/mth deal for 500MB...

Like damn you M1... I just downgraded my plan from 1gbps @ $44/mth to 300mbps @$29/mth.

And now you offer 500mbps @ $29/mth.

It's pretty frustrating, cos something like this happened 2 years ago as well.

It doesn't really affect me cos I don't think that the extra 200mbps speed will change my life in anyway.

But it still makes me a bit upset cos... hey, I got a worse off deal...

And of course the most important part of Comex deals.

The prepaid section...

Oh man... M1... you've disappointed me again...

Previously, during these fairs, M1 offered...

$18 top up card, I get a $21 value. Similar to the picture. This is a given.

(This bonus $3 is pretty worthless to me cos it expires within month.)

On top of that, they would give me a separate free $5 top up card which I can use to top up at anytime.

That's $23 of cash value on my top up for $18 spend. ($18+$5)

During the last computer fair, they started giving away this free bonus value for E-top ups.

What happens is the customer (me) goes to top up during the fair, I pay $18, the staff will give me $18 cash value in my account and $3 of bonus value AND another $6 of bonus value due to the promo. All this is done electronically via a laptop at the booth.

But all this bonus value expires in 1 month. So I basically get bonus value which I don't really use.

What I would prefer is not the bonus value but another top up card, cos that would allow me to top up at any time. Usually at the end of 6 months when most of my credits have been used up, that allows me to continue using my card for an additional month. Cos in my case, I'm more concerned about the validity period rather than the bonus value which expires and cannot be extended.

Oh well... Can't be helped. Doesn't really affect me, but I expected a better deal. Can't win 'em all.

<<PREVIOUS POST // NEXT POST>>

RSS Feed

RSS Feed