Well... Nope...

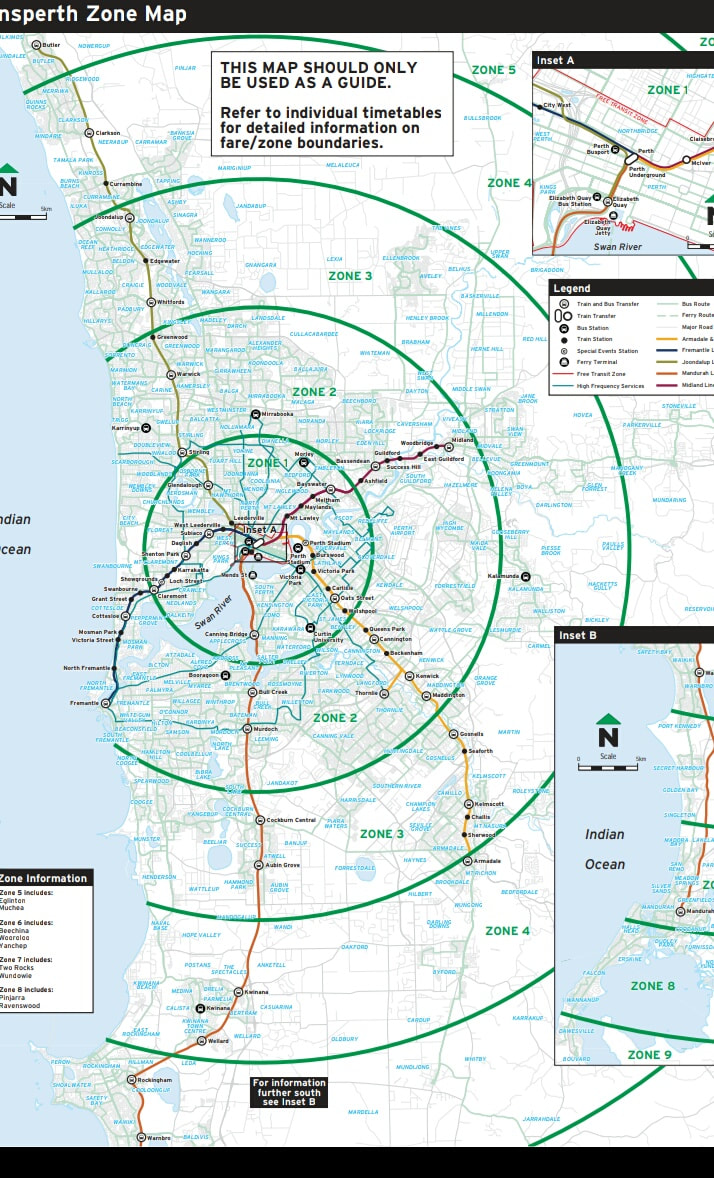

Here's a map of the train routes.

I went to all the end stations...

Except for the end of the yellow line. I was lazy. I stopped at Thornlie which is halfway.

Mainly, all I see are rows and rows of houses.

There's some shops around... And along the train ride there are factories and wood lands, and the occasional 'mall', it's like IKEA but for other stuff.

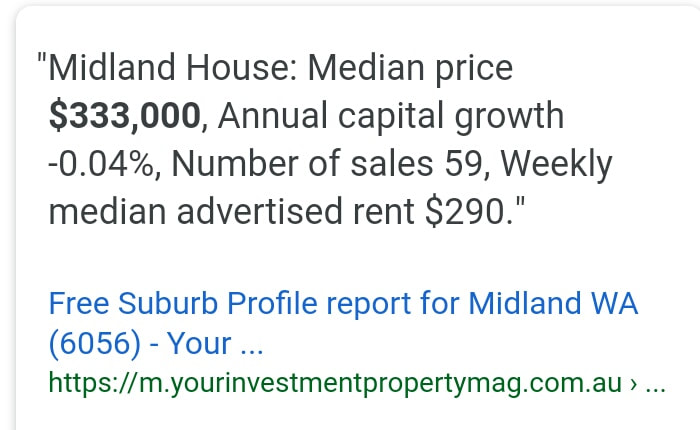

What was interesting is when I got Midland. Which is the last stop for the purple line.

There was a supermarket there as well...

And here are the prices....

You'd think that if I left central Perth, the prices would get cheaper? Well doesn't look like it. If you compare these pictures with yesterday's pics. There's almost no difference. It surprise d me... Really. I had expected some cheaper food and maybe in larger packaging. But nope. All the same.

The rest of my time on the train I was just pretty much seeing these for hours...

Rows and rows of houses...

And trees...

Home prices in the outskirts aren't cheap as well.

Mortgage rates are high... Hey but at least they own their own homes at the end...

Well long story short.

Today was pretty boring.

If you want to do some shopping, then it's mainly found in Perth City, Fremantle, and maybe Joondalup, which has quite a large number of shops and is quite a large retail center.

I do recommend Joondalup, cos it's a novel area. But it's hard to get around. Cos the retail buildings are quite stand alone and you have to walk very far, so a vehicle would be good.

Besides these, I think the other attractions are the usual ones, wildlife parks, sand dunes, vineyards, etc...

But as I think about it.

If we don't visit the zoo often, would local Australians visit their wildlife parks often?

I reckon they would probably love their lives very similar to us.

Work, home, and some simple weekend activities.

Same same in every country.

<<PREVIOUS POST // NEXT POST>>

Did you like this post? If so, could you "blanjah" me 1/4 cup of my morning coffee pls.

You may also consider subscribing to receive the articles in your email, link in the column on the right.

RSS Feed

RSS Feed