We don't talk about it much...

Execution.

In the show the Big Short, as referenced above, Michael Burry says, "I may have been early but I'm not wrong."

The response to that, by another character is... "It's the same thing."

You see, being early IS wrong, in the world of trading and investing.

If Michael Burry could not pay for his swaps, his swap positions could have been closed out before he made his money. And he was really close to being closed out.

I knew some people, who knew some people, who knew a group of people who got some info about an investment. Everyone got the same info. Everyone executed it differently. Some folks made a lot of money. Some folks lost a lot of money.

Some were too early, some believed the info but changed their minds halfway, some couldn't stomach the volatility, etc.

Or on a more personal note, I made an investment. It went up 60% and hit my price target. I got greedy, thought to myself. It has more room to run. Left it alone for a couple of months. Now that position is only up 20%.

So I was right, my expectations were met. It hit my price target. I should have sold.

But in the end I was wrong. I didn't follow through with my execution.

We talk about long term investments.

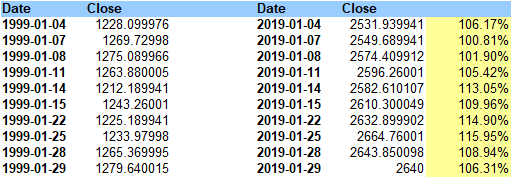

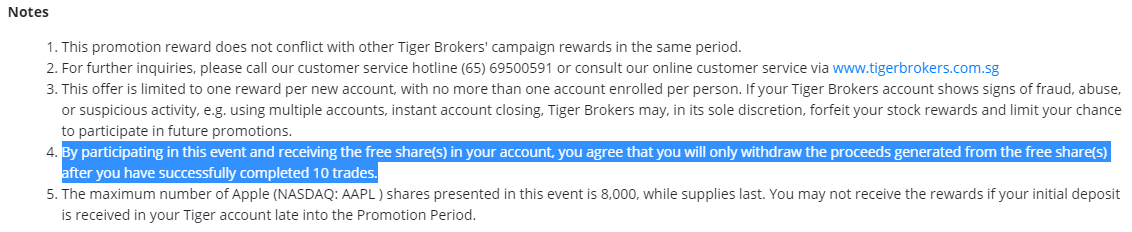

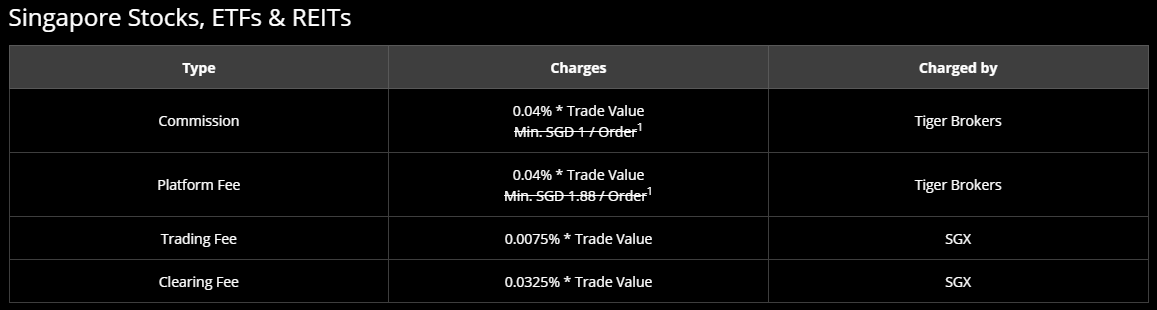

See table below.

20 years.

Not all the dates coincide. Cos of weekends and such.

So I only took the dates that coincided with each other and removed the dates that didn't match 1:1.

Didn't want to pull data for 20/21 cos it's during COVID.

So from the data... we can see. If a person made a 20 year investment on 7 Jan 1999, he would end up with 100.81% return.

But if someone else made an investment on 25 Jan 1999, he would end up with 115.95%.

That's quite a large difference.

I mean... we all read about passive investment, hold long term, time in the market vs timing the market. DCA, trying to beat the S&P, trying to beat STI, tracking error, etc...

And yet... the difference could just be whether you choose to add to your portfolio on the 15th of the month instead of rebalancing at the end of the month.

When we try to benchmark against others... then there's no end to comparing. Might as well benchmark against our own performance but on different execution days.

In the end, investment is pretty simple.

Just make money. AND to hold on to it.

<<PREVIOUS POST // NEXT POST>>

Did you like this post? If so, could you "belanjah" me 1/4 cup of my morning coffee pls.

You may also consider subscribing to receive the articles in your email, link in the column on the right.

RSS Feed

RSS Feed