Here and here...

I've gotten slightly more interested to track my expenses just to see how freegan activities have improved my spending.

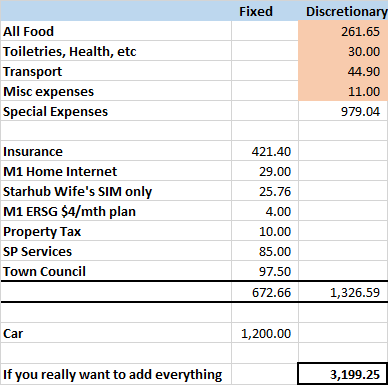

Below is the amount for March.

I've changed some of my classification to group stuff up.

Nothing to really talk about for the fixed section.

I've mentioned about those before in my previous posts.

Insurance is subjective, everyone can buy whatever insurance makes them feel more secure.

Personally, our insurance contains...

Housing insurance, decreasing term life insurance, early crisis cover, SAF life insurance.

All the internet and telco plans I've also spoken about previously so nothing exciting.

I've always kept car as a separate line cos it's treated differently. Cos this number also includes depreciation or estimated monthly payments. Cos it's already fully paid.

Also, this number disappears if my wife changes job so...

Anyway, this $1,200 is the "budget" set aside for the car, and it will always be counted separately.

I've written a post somewhere in the past, so let's just leave it as that.

The more interesting portion is the pink section. Cos that's discretionary spending.

This section adds up to $347.55.

This is basically living expenses. I think we did very well this month.

Transport expenses is when we take MRT out instead of the car.

Food is $261.65 and Toiletries, health products is a mere $30.

Ok there's some cheats here, cos we use the AIA Vitality app to subsidize our spending on certain grocery for food stuffs at Cold Storage. So all these don't show up on the expense list.

But that's what this game is about, finding "lobangs" to save real cash.

A lot of the food expense is cos we went to Malaysia for 8 days this month, so we spent on my food, the other thing that added to this number is my wife's daily lunch.

Misc expense is for stuff like buying a "gift" like buying a friend a drink or a meal, or a birthday gift, maybe if I see a doctor, etc.

What so important about this pink section?

Cos this is the spending for daily life. It will likely never go away. If I have lifestyle inflation, it will show up here. These are the choices of my daily life, with little or no excuse. If I eat a steak or chai-png, it shows up here. If I take taxi, it shows up here. Or if I buy Starbucks, eat out, etc... all will appear here.

I'm not 100% freegan, there's some stuff which I feel isn't worth the trouble to try to obtain for free.

Or some items which I have a preference to, like shampoo or skin care products, etc.

Special expenses is a whopping $979.04.

This is unfortunate. Special expense is what I would consider expenses that don't pop up often or aren't supposed to pop up often or will disappear if the situation changes.

There's $600 worth of dental expenses. ($700 more to be paid in Apr.)

And the remaining $379.04 is for 4 of my flights to Malaysia.

I'm not too bothered by special expenses cos these are just expenses which aren't supposed to happen often or will disappear as time goes along, like if my wife changes job, or changes job scope.

And definitely the dental procedure shouldn't be happening often. This is not the regular half year check ups, those would be classified under misc expenses.

Ok that's it for today's post. Nothing much, just a check point.

It was great that we managed to bring discretionary spending down to under $500 which is pretty much what I wanted to achieve this year. Hopefully this continues into next month, but there's going to be other expenses as well, cos we're going to be going overseas and all that.

<<PREVIOUS POST // NEXT POST>>

Did you like this post? If so, could you "blanjah" me 1/4 cup of my morning coffee pls.

Many thanks for continuing to come to this blog to read my posts.

RSS Feed

RSS Feed